Why so many economists underestimated the inflation problem

Experts who focused on the supply chain missed the forest for the trees.

The Bureau of Labor Statistics announced on Thursday that the annual inflation rate has hit a new 40-year high of 7.5 percent. This ran contrary to the expectations of many analysts who predicted last summer's inflation surge to be transitory.

Chief among them was Federal Reserve Chair Jerome Powell. In an article last August, Reuters laid out Powell’s reasoning. Powell saw inflation as concentrated in a handful of categories. At the time, the prices of used cars were up by about 40 percent, as were gasoline and other petroleum products. More broadly, the prices of consumer durables—stuff like furniture, home appliances, and exercise equipment—were rising far more than average.

Consumers in 2021 had a lot of extra cash thanks to pandemic-induced saving plus several rounds of stimulus spending. At the same time, lingering fears of COVID made many consumers reluctant to go to bars or theaters, or use other services that involved face-to-face contact. So instead they spent money on stuff for their homes, overwhelming the supply chain for everything from hot tubs to dishwashers.

Last August, Powell said he expected supply-chain issues to be sorted out relatively quickly. Moreover, as COVID receded, consumers would buy fewer durable goods and more services. As a result, the inflation rate would move back toward the Fed’s 2 percent target.

Obviously, that isn’t what happened. And his mistake provides a useful lesson in how to think about inflation in the future.

Durables vs. services

To be fair to Powell, lots of people underestimated the inflation problem last summer—I certainly did. But one expert who sounded appropriate notes of caution last year was Jason Furman, a former economic advisor to Barack Obama who now teaches at Harvard. Furman is quoted in that August Reuters article accusing Powell of “failing to take seriously any arguments on the other side.”

In November, Furman wrote a tweet thread that offers the best explanation I’ve seen for why so many people misjudged the inflation situation last summer.

1. MACRO: inflation is determined in aggregate (e.g., total stimulus).

2. MICRO: developments in individual markets (e.g., cars) determine inflation.

The later approach isn't entirely irrelevant but vastly overblown in analyzing inflation.

A 🧵

Many saw skyrocketing prices for cars and gasoline and—like Powell—blamed it on supply chain difficulties. And they weren’t entirely wrong: chip shortages really did contribute to the shortage of cars, for example.

These micro thinkers assumed that once the supply chain problems got sorted out, the prices of cars and gasoline would come back down. So to forecast future inflation, they tended to focus on other components of the consumer price index that weren’t rising so fast.

But Furman pointed out that this reasoning had a crucial flaw: “If people have a lot more money to spend and car prices did not go up then maybe they would have spent even more on other stuff and inflation would have been similar in aggregate, just spread out differently. The high US car price inflation likely drove down demand and prices for other stuff.”

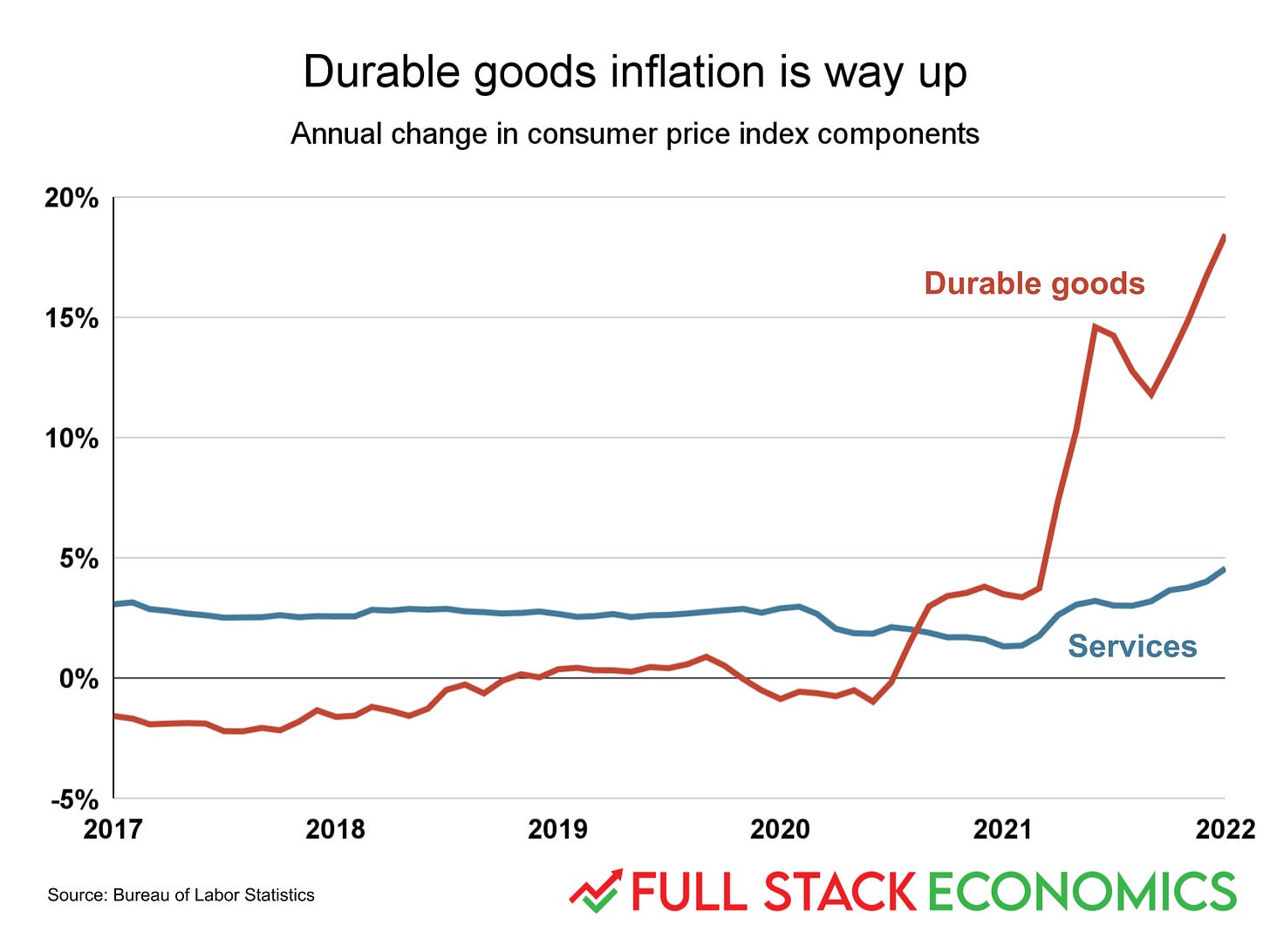

We can see this graphically by looking at inflation data over the last couple of years:

Something to keep in mind when you look at this chart is that services (which includes shelter) accounts for more than 60 percent of consumer spending, compared to around 11 percent for durable goods. So a 1 percent change in service costs has a bigger impact on the headline inflation figure than a 5 percent change in durable goods. In other words, the small changes in the blue line during 2021 are a lot more significant than they look.

I’m focusing on services and durable goods because these two categories traditionally have fairly predictable prices. The third big category, non-durables, accounts for the remaining 26 percent of spending. It includes food and energy costs that tend to fluctuate more.

From August 2020 to March 2021, we had a healthy recovery led by durable goods. During this seven-month period, durable goods prices rose at an annualized rate of 3.1 percent, while the price of services rose at an annualized rate of 2.1 percent. Notably, services inflation was running a bit below the 2.4 percent rate that had been typical for services before the pandemic. This helped offset higher-than-normal inflation for durable goods.

But in April 2021, the inflation rates for durable goods and services started to rise together. Between March 2021 and January 2022, the price of services rose at an annualized rate of 4.7 percent, while durable goods rose at an annualized rate of 21.9 percent!

And this is where Furman’s insight is important: if durable goods inflation had been lower, that would have left more money in consumers’ pockets. They likely would have spent some of it on other categories, including services, pushing up service prices further.

So while the manufacturing difficulties of carmakers certainly contributed to the high inflation of the last year, it wasn’t the main culprit. If carmakers had had their acts together, the extra spending likely would have sloshed into some other part of the economy and we’d be talking about a different set of supply-chain bottlenecks.

You can see hints of this in Thursday’s data release. It shows gasoline prices falling and car inflation moderating. But inflation for food and clothing seemed to be accelerating in January, with food prices rising 0.9 percent in a single month and apparel rising by 1.1 percent. On an annualized basis, these are double-digit increases.

Of course, we shouldn’t read too much into one month’s worth of data. But looking at the release as a whole, it’s clear that the headline inflation figure of 7.5 percent isn’t just being driven by a handful of categories like gasoline or used cars. True, some prices are rising faster than others, but that’s always true in times of high inflation.

Ultimately, prices have been rising over the last year because consumers’ spending power has outpaced the economy’s ability to produce goods and services. COVID-related bottlenecks in particular industries certainly don’t help, but they don’t seem to be the main issue. And this means that inflation over the next year will depend a lot on what the Federal Reserve does to keep demand under control.