The inflation outlook, in two simple questions

It all comes down to a simple equation: inflation equals nominal minus real.

Even in normal times, inflation as a subject attracts a lot of poor analysis. Yesterday’s release by the Bureau of Labor Statistics, which showed inflation rising at 7 percent over the last 12 months, is sure to attract more than usual.

A simple way to cut through the noise is to decompose inflation into two parts. Nominal growth in consumer spending equals the real growth in consumption, plus inflation. Or alternatively, inflation is the difference between nominal growth and real growth.

This simple equation is what economists call an accounting identity: it’s true by definition. But it helps us think clearly about inflation by focusing on two basic questions.

Question One: What is the shape of the nominal recovery?

Our macroeconomic policymakers endeavor to keep nominal income growing at a steady clip—in fact, some economists want the Federal Reserve to target this number explicitly. This matters for inflation because people’s spending can’t exceed their incomes for very long. So moderate income growth means moderate spending, which in turn will produce moderate inflation.

However, this became more difficult over the course of the COVID-19 pandemic. People lost market income when businesses closed, but many of them got sporadic transfer payments from the government to tide them over.

The overall path of income during COVID-19 was messy, as I’ve written about before. But overall it tended a little bit above trend. That is, people have had slightly more dollars in income than they would have had if normal pre-COVID life had continued. They were also able to accumulate savings by forgoing some consumption, presumably from shutting down activities.

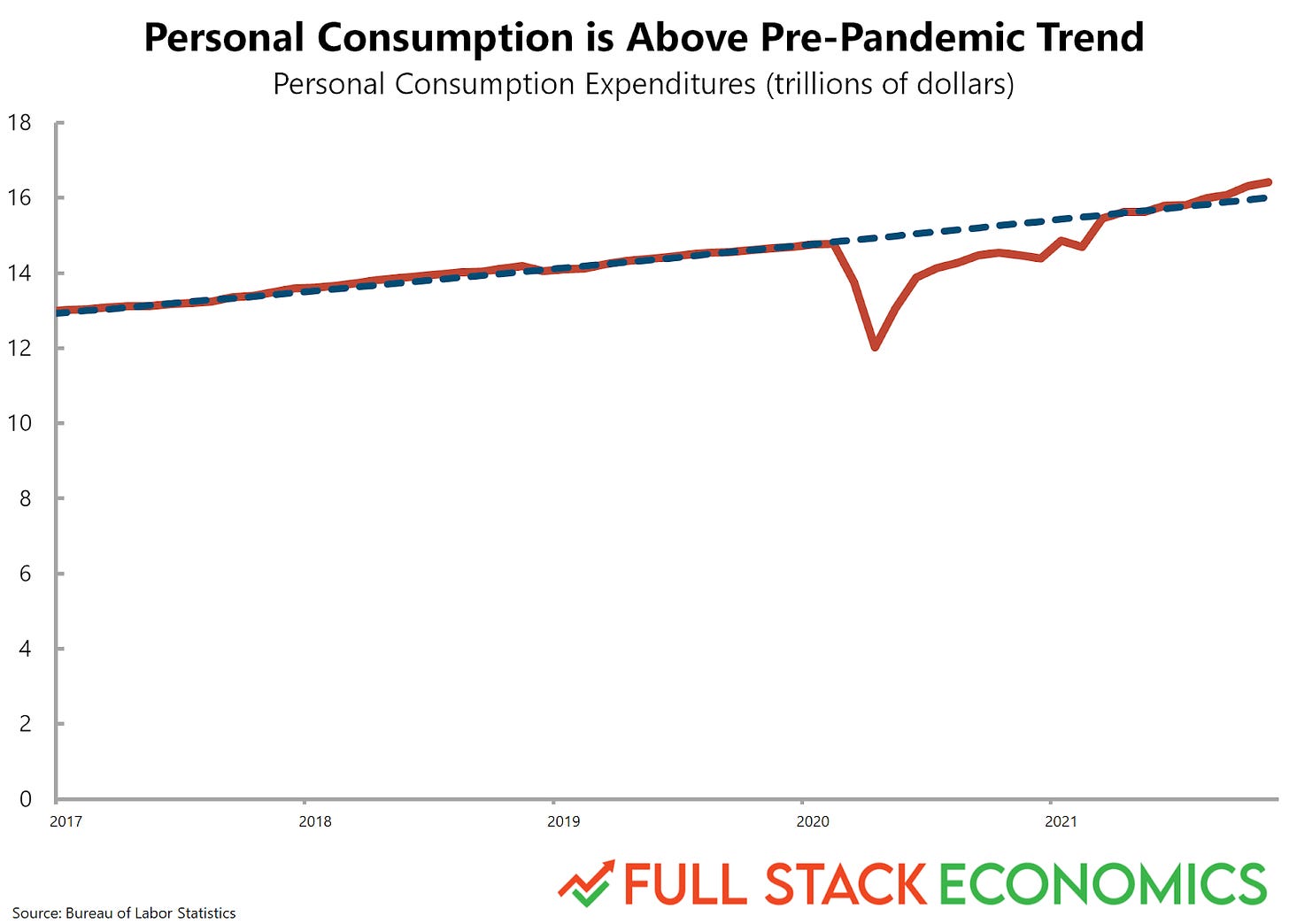

The result is they have more money to spend, and lately they’ve spent more money (about 2.5% more) than they did under the pre-COVID trend. These extra dollars are a contributing factor to inflation.

Question Two: What is the shape of the real recovery?

The next question is simple: how well can our real economy produce the things people want? We have two problems. The obvious problem is that COVID-related inconveniences have made people less efficient at their jobs. A subtler problem is that COVID-19 made consumer demand less predictable. For example, producers were surprised at the beginning of the pandemic when more people wanted goods delivered, and fewer people wanted in-person services, for reasons of safety or convenience.

Compounding the problem, a lot of people suddenly wanted big durable goods, like at-home exercise bikes, for their homes. But it’s not clear if this increased spending will continue in the future. As our friend Joseph Politano of Apricitas notes in his most recent post, “durable goods are, well, durable,” so once that demand is sated it could easily reverse.

In short, the combination of workplace inefficiency and unexpected shifts in demand has resulted in less total production, contributing to inflation from the supply side, or “real” side, of the “inflation equals nominal minus real” equation.

The question is if and when these problems will reverse. The best possible outcome would be COVID fading away quickly. This could create a “V-shaped” recovery where production problems get solved and we return to prior trends as if this all never happened.

On the other hand, if COVID’s inconveniences prove more permanent, that could produce an “L-shaped” recovery. We’d get growth again, but we’d never catch up to where we could have been without the pandemic.

Permanent, happy transitory, sad transitory

All of this gets us back to the question of what will happen to inflation. Specifically, will it be permanent or transitory? The answer to this question lies mostly on the nominal side of our inflation equation.

Any scenario where prices continue to go up at the high rates seen recently requires fast-rising incomes. You just can’t have a sustained period of 7 percent inflation unless nominal incomes and nominal spending are consistently rising 7 percent faster than real output.

And policymakers are already moving to make sure nominal incomes don’t continue rising that fast. Sen. Joe Manchin (D-WV) has emerged as an obstacle to adding new accommodative fiscal policies, and the Fed seems to be tightening monetary policy.

If they succeed, then we will have “transitory” inflation, in the sense that the inflation rate will fall over the next year or two. But it’s important to distinguish between what I’d call a “happy transitory” scenario and a “sad transitory” scenario. In both scenarios, nominal income and spending are well stabilized, so the price level is determined by real productivity. The higher the productivity, the lower the prices, and vice versa.

The happy transitory scenario is where we defeat COVID-19’s major inconveniences and get a V-shaped recovery in the real economy. This would mean that scarce items like autos rebound to full production, the efficiencies of the pre-COVID era return, and plentiful production races to return prices back towards normal levels.

In these circumstances, we could see incomes rising strongly even as inflation falls below 2 percent. The price level forms an upside-down V, rising sharply and then declining in the recovery. We might even get a bit of deflation that “makes up” for the bad inflation we suffered earlier. While deflation is an ominous sign if it signals the start of a recession, falling prices produced by rising productivity can be a healthy sign.

In the sad transitory scenario, on the other hand, many COVID inconveniences stay with us forever. This creates unpredictable problems and slows down production, producing an L-shaped recovery. We eventually learn workarounds, but we won’t be as rich as we would have been in a world without the virus. In this scenario, the price level forms an upside-down L, so prices rise sharply and stay at those elevated levels without any "make-up" years of low inflation.

Of course, these scenarios aren’t all-or-nothing. Reality is likely to be somewhere in between, with some industries fully recovering from COVID and others hampered by logistical issues. But at least in 2022, I expect the “sad transitory” narrative to be strongest.