Sorry, collectibles are terrible investments

Nobody wants your beanie babies. And even "serious" collectibles are mathematically destined to underperform.

Every once in a while, otherwise sane people convince themselves that collectible objects are good financial investments. Sometimes they invest in long-run asset classes like stamps or art. Sometimes it’s ephemeral crazes, like Beanie Babies. One of the newest is non-fungible tokens, which are unique units of data stored on blockchains. I expect they will end up in the ephemeral category.

But all of these asset classes are bad investments from a financial perspective, whatever their boosters tell you.

Collectibles have a fundamental flaw: they don’t generate cashflow. In fact, after maintenance, storage, deterioration, and transaction costs, their cashflow is usually negative. That means that in the long run, they'll consistently under-perform conventional assets like stocks and bonds.

Promoters work hard to confuse potential investors about this. They point to isolated examples of collectibles that produced outsized returns and suggest that you can enjoy those same returns. But most likely, you can’t.

You might justify owning some collectibles because it gives you joy to see them, providing a psychological return. That’s fine; if your collection brings you joy, keep it. It’s fine to have hobbies. But one shouldn’t delude oneself—or worse, others—into thinking that hobbies are good schemes for wealth-building.

An ironclad rule keeps collectibles from beating stocks

Collectibles don’t generate cash flow like bonds or stocks. They can only make you money through appreciation. Perhaps that doesn’t sound like a big constraint. But it is, because in the long run, assets without cash flows cannot increase in value more than the economy as a whole. If something appreciates faster than the whole economy in the long run, it eventually eclipses the whole economy, which is impossible.

But stocks and bonds have a property that gets them around this problem. They can (and do!) get a total return that is larger than the economy-wide growth rate. They do this through interest payments, dividends, and buybacks. Suppose the economy as a whole grows at 5 percent annually. The stock market might also appreciate at 5 percent in terms of market capitalization, but also yield a 3 percent annual dividend, giving you an 8 percent return overall. This actually isn’t a hypothetical. It is pretty close to the real-life historical numbers. Stocks can achieve, and historically have achieved returns that are impossible without cash flow.

There’s a place for zero cash flow assets, and always will be. Some share of the economy will always be devoted to Picasso paintings, 1977 Kenner Star Wars figurines, or obscure 19th-century stamps. But that’s a limited pool of money and attention, and its value is bounded. If a new collectible becomes popular, it erodes the mindshare and the market share of at least some incumbents.

And as I mentioned earlier, collectibles usually have negative cash flow. You need to pay for storage to keep figurines or art or stamps pristine. Small items like baseball cards can easily be lost. Not even non-fungible tokens (NFTs), an entirely digital collectible, completely solve the depreciation and loss problem, because they have famously been lost or stolen.

It’s easy to imagine that you’re the sort of person who wouldn’t ever lose or damage valued items, so these critiques don’t apply to you. But the odds are you’re not.

Another big problem for collectibles is that the buying and selling process isn’t smooth. It’s a viper’s den of scamsters.

It’s also easy to imagine that you’re the sort of person who can navigate a web of scam transactions and bad information. But the odds are you’re not.

Even if you are, you’ll still have to go through a costly verification process to prove that what you’ve collected—or what you’re about to collect—is authentic. Often this needs to be proven and re-proven. The verification process will eat into your returns.

I wouldn’t invest with this art company

But those who promote collectibles work hard to make you forget the flaws. Let’s take an illustrative example: Masterworks, a company that allows people to buy partial shares of expensive artwork. The pitch reads “our mission is to democratize art investing, a $1.7T asset class.” And note that this is really just investing, not art enjoyment. You don’t get to have the art in your house.

They work overtime to sell the asset class. But if you know what to look for, you can spot the tricks relatively easily.

“According to Artprice,” Masterworks tells us, “the value of blue-chip art has outpaced the S&P 500 by 180% from 2000–2018.”

That’s a staggering outperformance. Too staggering. I looked at Artprice’s description, and two things immediately jumped out at me. The first is that they have another index, the Artprice Global Index, which appreciated relatively little—about 40 percent—over the same period. It’s clear that Masterworks saw the performance of both indexes, and chose the more favorable one after seeing the results—a luxury they won’t have when selecting portfolios for the future.

The second thing was that Artprice’s returns for the S&P 500 exclude dividends. The S&P 500 opened at 1469 in 2000, and opened at 2684 in 2018—about an 83 percent appreciation, which is reflected on Artprice’s chart. But you don’t just get appreciation from stocks, you get cash, too. With that cash reinvested—as you would do automatically in a typical retirement account invested in an S&P500 Index—you would have a gross return of 161 percent, not 83 percent. 83 percent is what you get if you light the cash on fire.

And on the flipside, this index, like most indexes, elides storage and maintenance costs. Businesses record such things as expenses or depreciation. But art indexes, compiled from public auctions, don’t have access to that information, and don’t include it—a happy coincidence. But when it comes to artwork, the costs of preserving older pieces are a big deal.

Masterworks charges management fees: 1.5 percent of the value of the portfolio each year, plus 20 percent of the gains. These are close to typical active management fees in many industries.

Management fees are a fairly powerful drag on your portfolio, compounding annually. For example, a 1.5 percent management fee over 18 years eats up about 24 percent of your whole portfolio. Not the gains, the total. If you had invested in a portfolio like the Artprice Global Index, this fee alone would eat up most of your gains.

Many stock investors have come to the conclusion that management fees are a bad deal. Automatic trading strategies run by firms like Vanguard have reduced fees to tiny fractions of a percent, and these low-fee index funds have largely outpaced actively managed portfolios.

But art can’t have the same low-fee passive index funds that stocks have. Because each piece of art is different, you can’t use computers to freely flip around shares of art, sight unseen.

Worse, the fees I’ve mentioned so far may not be the only ones clients pay. Masterworks includes a further disclaimer: “Additional expenses and fees associated with acquiring, sourcing, securitizing or selling the painting may be paid by the issuer.”

Masterworks’ legal disclosures section—which is quite thorough—acknowledges the impact of fees.

There are other useful acknowledgments in the disclosures—that the market may be very illiquid, unlike the market for common stock. Investors can’t just pull out their money on request, they have to wait until Masterworks sells the art (though Masterworks facilitates a secondary market, which might make it possible for users to sell their shares to another user.) Usually, illiquidity is a substantial drawback for investors, so firms with illiquid portfolios, like real estate, private equity, or venture capital, need to earn a premium to compensate.

Past performance is no guarantee of future results

Most importantly, the legal disclaimers acknowledge that measurements of past performance are not going to be reflective of future results. This is a concern with many investments, but collectors are particularly prone to measurements of the past that fail to replicate in the future. They are at risk of measuring the most successful collectibles retroactively, effectively dropping less successful ones from their sample.

There are some obvious ways of doing this, like hypotheticals (“if you had bought a household name when he was still toiling in obscurity…”) or retroactively picking out the better of two Artprice indexes.

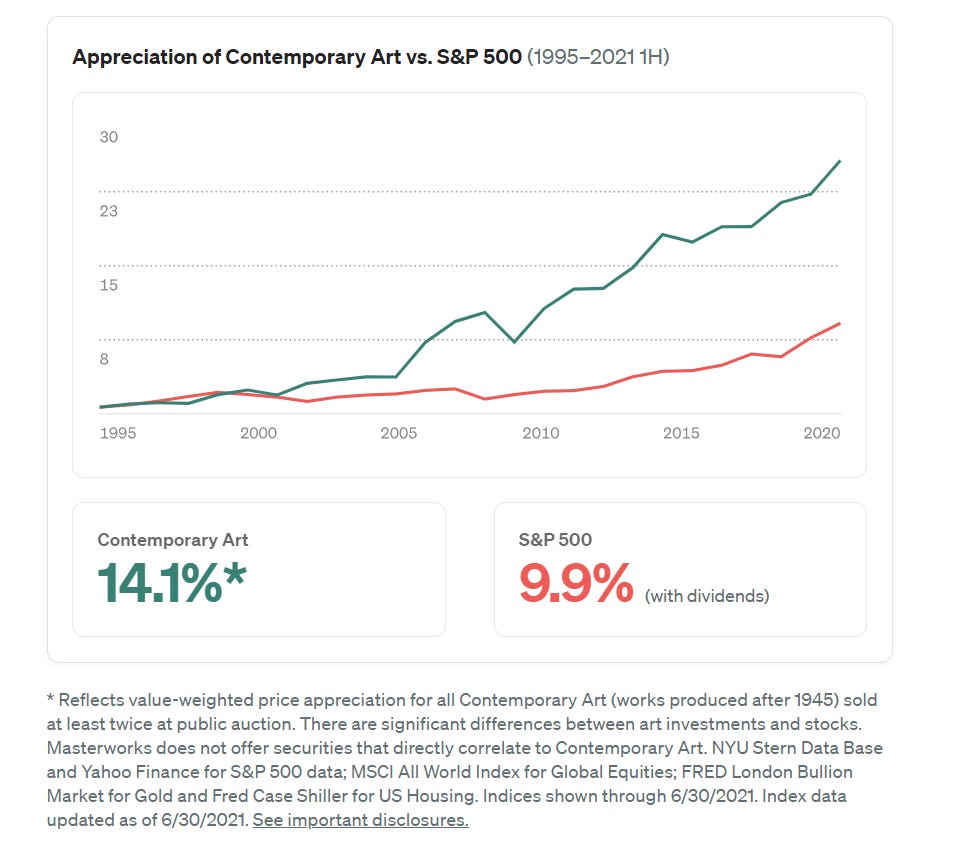

But there are also more subtle issues that can arise, even in seemingly rigorous approaches. For example, take the repeat sales data shown in Masterworks’ own comparison between contemporary art prices and the S&P 500.

Masterworks did, for what it’s worth, remember to include dividends, unlike the Artprice comparison they cite. But there are other issues with this comparison. By restricting the range to works sold twice or more, they must end up excluding those works that were sold once and never again.

This effectively smuggles in information from the future. It starts measuring the performance of a portfolio from 1995, but it defines the portfolio in part based on events that happened in, say, 1999 or 2003—events that would have been unknowable in 1995.

The exclusion of works that aren’t resold might matter a great deal. There’s a good chance those works ended up in that category because there was less demand for them. And prospectively—if you’re creating a new portfolio—you don’t know which category it will be in.

Masterworks did not respond to a request for comment.

Nobody will buy your Beanie Babies

Perhaps the most infamous collectible fad of my lifetime was Beanie Babies. These were toys made by a company called TY whose popularity peaked in the late 1990s. The toys retailed at or about $5, and were loved by plenty of children growing up then. Each one had a name. My siblings and I owned a couple of Cheezers (mice), a Tiny (a chihuahua) and a Patti (a platypus).

But these toys also became a euphoric, massive collectibles market. It’s hard to overstate the amount of attention they received. Some of the toys were resold for thousands of dollars. People hoarded new ones, phoning stores across the country to get their hands on certain ones. The phenomenon was regularly covered by the serious financial press.

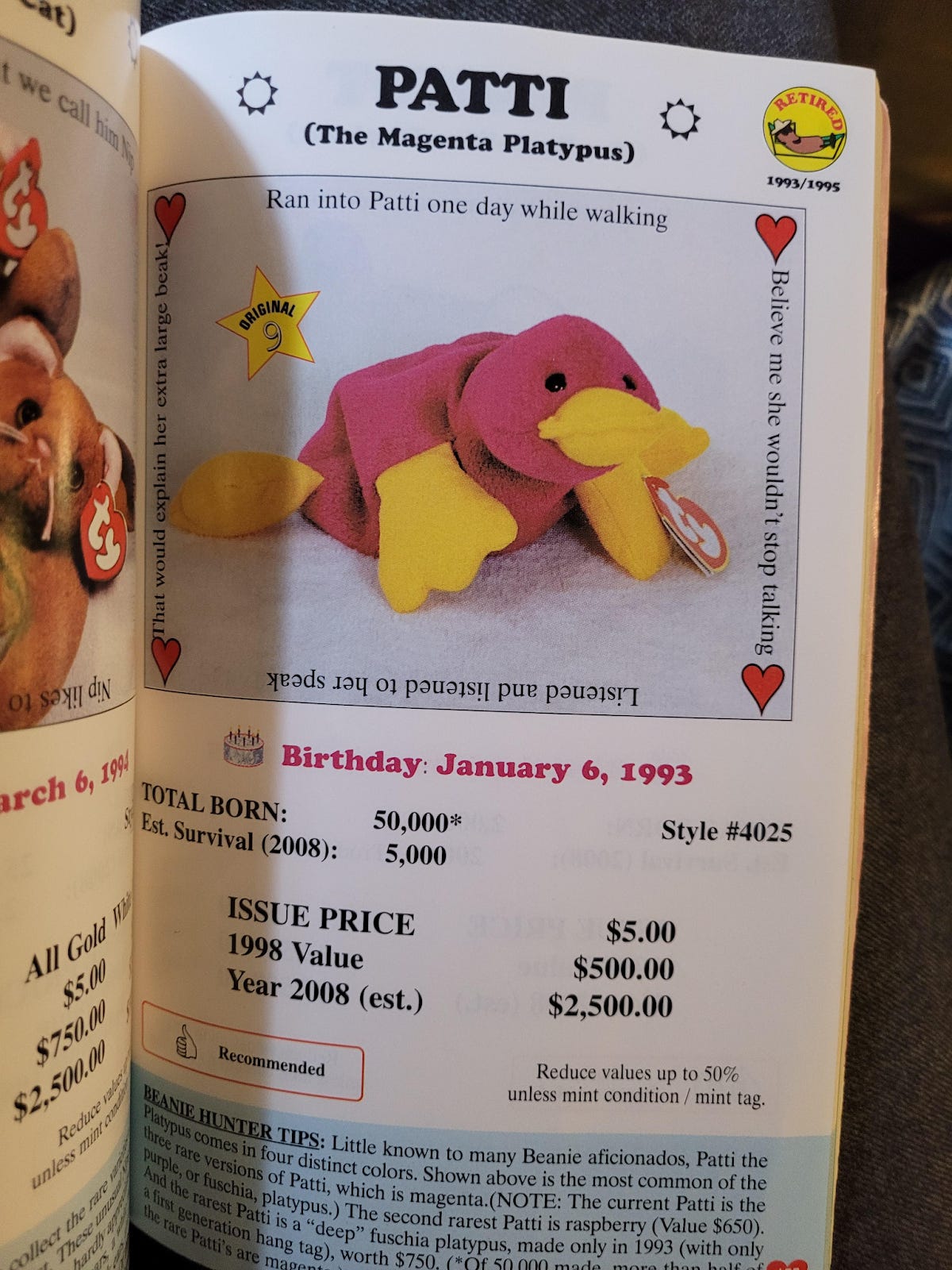

Popular price guides circulated, with astronomical projections for rates of return on certain Beanie Babies. Earlier this year, reddit user monkey616 unearthed such a guide and posted a picture.

Monkey616 happened to photograph the page that includes Patti, my own platypus. And it includes an eyepopping number—$2,500—as the projected price for Patti as of 2008, and even a value of $500 as of 1998, which was presumably when the guide was published. These values were typically inflated—people liked to hear that their collections were valuable—but the bigger problem with the guide is a little bit more complicated.

I’ll spoil the punchline. My Patti is not worth $2,500. It’s not worth $500 either. But this page is instructive. From just one page, you can learn practically everything you need to know about Beanie Babies. “Patti” isn’t a single entity, but rather, at least four distinct items, made in different colors. The one pictured on the guide was the Magenta Patti, the third rarest. The rarest of all is the Deep Fuchsia Patti. And the current and least rare Patti, the guide says, is a Fuchsia Patti. No price is mentioned for the Fuchsia Patti, because the Fuchsia Patti was, and is, worthless, except as a children’s toy.

This may sound confusing—perhaps almost deliberately so. Deep Fuchsia is your golden ticket, and Fuchsia is worthless. It’s like the company functionally counterfeits its own product. But this blurred line between the rare items and the common ones is what drove a lot of people to hear about—and buy—the common items.

You can guess which Patti I have.

You can also guess which one you have. I imagine some of you recognize the fuchsia monotreme (deep fuchsia or otherwise) and you know it’s stored somewhere in your childhood home’s basement, and you’re thinking about checking which kind you have.

Don’t bother. You have the worthless fuchsia one. Everyone does.

To understand why, we need a little history. TY and the Beanie Babies product struggled between 1993 and 1995. Many toy stores weren’t even willing to stock them. In 1996, they broke through and became popular in the suburbs of Chicago. A couple of years later they were ubiquitous.

The central problem for those hoping to get rich off of Beanie Babies in late 1996 or 1997 is simple: they were too late. The variants that piqued the curiosity of collectors were the early, rare ones.

Without getting into too much detail, the Beanie Babies that might be valuable are almost always those with the first, second, or third generation “hang tags”—little red heart-shaped tags attached to the critter, with the TY logo on them. Those hang tags, easily recognized because they have no extra adornment on them besides the logo, were in use between 1993 and early 1996, when TY was an unpopular company toiling in obscurity. Presumably, many of these toys were used by children, damaged, and lost.

When the toys became popular, production took off and the toys were produced by the millions with hang tags of the fourth generation and later. Yet to many people, those later beanies—obviously ubiquitous—somehow still retained the reputation of being potentially rare, driving buzz and getting people to buy them, and at times, store them carefully.

The subreddit for Beanie Baby aficionados has just 4,300 subscribers, which suggests that Beanie Baby interest is a fraction of what it was in its heyday. New users are directed to a rules post. The first three items are all repetitions of the same rule: If you don’t have one of the three original hang tags, stop asking.

I think there’s a good chance the Beanie Baby phenomenon actually took off entirely by accident. It was random luck that TY was unpopular at first, then popular later, creating a gold rush for obscure early editions.

But it would be hard to find the next TY. Tons of toy companies produce tons of obscure, unpopular toys. Only a handful of those become extremely popular later.

The TY example has a few parallels, like Star Wars collectibles. In 1977, it was not initially clear that Star Wars would become one the most popular franchises of all time. The maker of Star Wars toys, a company called Kenner, produced far too few of the toys. The result is that early Kenner toys were rare and prized, much like early Beanie Babies. But after a franchise becomes popular, the manufacturers step up production, just as TY did, and flood the market. They have no interest in underselling toys just to make secondary collectors rich.

This is the central paradox: if you’ve heard of a collectible, you’re already too late. But collectors and their promoters will often blur the distinction between rare items and common ones, in order to draw new people in.

I recommend simply enjoying toys for their own sake. My siblings and I have children of our own now, one old enough to play with the Beanie Babies in the closet of her grandparents’ house. Her favorite is the fuchsia platypus.