Inflation-adjusted college tuition is finally falling

College enrollment has been falling since 2012. The pandemic accelerated the decline.

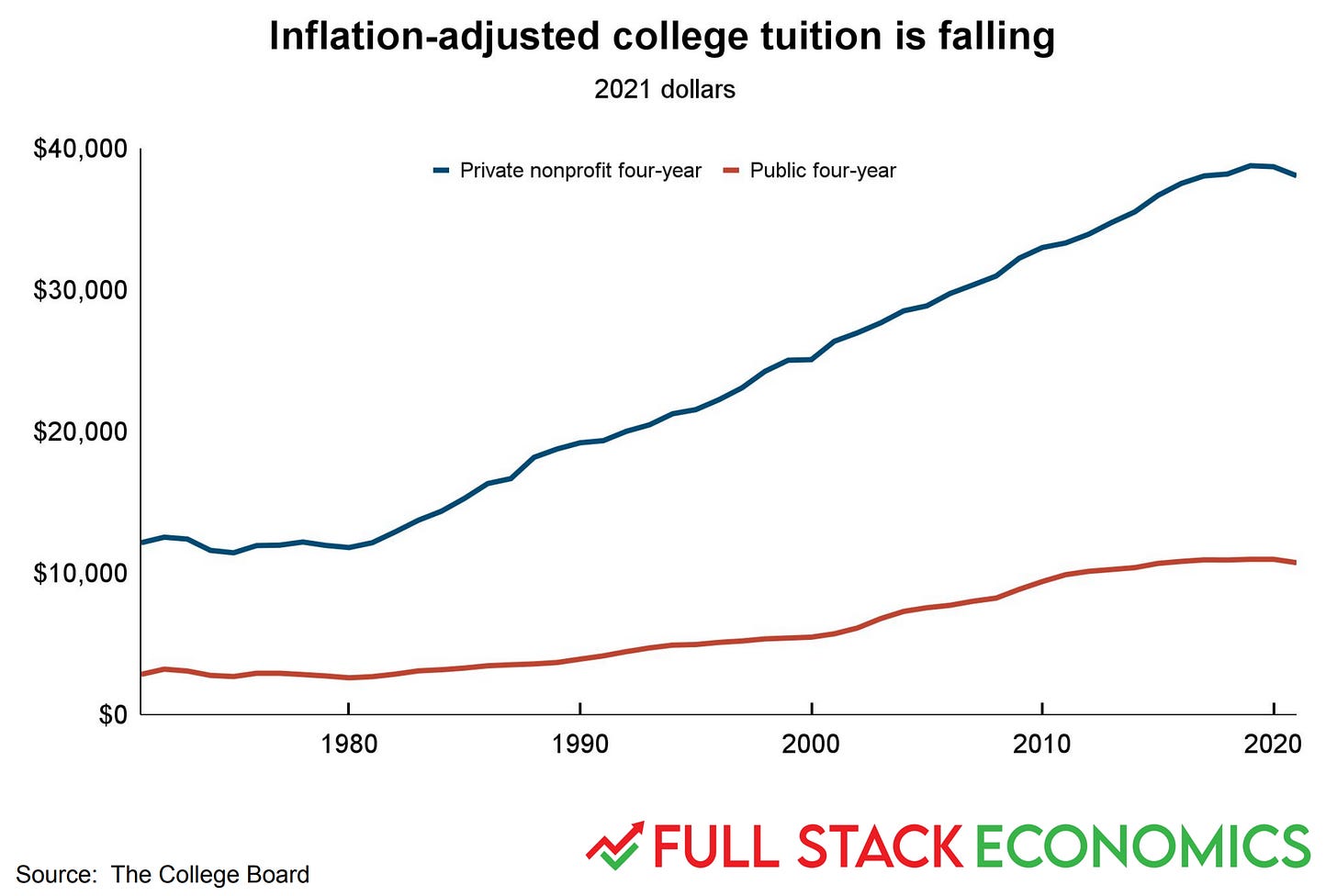

For decades, college tuition seemed to only go in one direction. For the 1980-81 school year, tuition at a private, non-profit four-year college cost an average of $11,810 in today’s dollars. By the 2019-20 school year, the cost had risen to $38,780—a more than three-fold increase in 39 years. Tuition at public four-year universities rose four-fold, from $2,610 to $10,980. All of these figures are adjusted for inflation, so a college education has been getting steadily more expensive in real terms.

But for the 2020-21 school year, public school tuition was flat (adjusted for inflation) while private tuition declined very slightly to $38,710. Now a new report from the College Board finds much more significant declines for the 2021-22 school year for four-year colleges. Private schools are charging $38,070, 1.6 percent less than last year. Public school tuition fell 2 percent to $10,740.

Most students don't pay the "sticker price" reflected in this data. Universities offer a wide range of both need- and merit-based scholarships that lower the actual cost for many students. This enable colleges to price-discriminate between wealthy and non-wealthy families. So it's possible that the true cost of college fell even faster.

Universities have been struggling with declining enrollment since 2012, and those declines accelerated during the pandemic. Undergraduate enrollment fell by by 3.4 percent for the 2020-21 school year and another 3.2 percent for the current academic year. A shrinking customer base makes it hard for universities to raise prices.

The pandemic has also reduced the quality of the college experience. During the 2020-21 school year, many colleges only offered partially or fully online instruction. Campus life has normalized somewhat this year, but there are still significant restrictions and a heightened risk that students could catch the virus.

Universities also have to contend with a booming labor market. Workers on the lowest rungs of the economic ladder are enjoying low unemployment rates and rising wages. Plentiful jobs can be a strong inducement for an 18-year-old who isn’t sure if college is right for them.

A final factor is the rising inflation rate. Universities set tuition rates in nominal terms, and they generally do so well in advance of an upcoming school year. Private schools raised their nominal tuition by an average of 2.1 percent for the current academic year. In a normal year with 2 percent inflation, that would have meant little change in the real value of tuition payments.

But this hasn’t been a normal year: inflation has been well above 2 percent. Indeed, to get its 2021 inflation figure, the College Board compares prices from January to August 2021 to those from January to August 2020. That yields a 3.9 percent inflation rate—far below the 6.2 percent inflation rate for the year ending October 2021. So the 1.6 percent decline shown in the College Board data almost certainly understates the true decline in real private school tuition. And colleges probably didn't intend to give students such a big discount when they set tuition rates a few months ago.

Whether tuition rates continue to fall in real terms partly depends on how much progress the US makes in battling the coronavirus over the next year. If things are on track for a normal school year in 2022-23, colleges may be able to start raising tuition again. If the US continues to be hit by new waves of COVID-19, on the other hand, then colleges might be forced to cut tuition once again.

Did you enjoy this article? It's shorter than our other pieces and required less in-depth research. I'd love to know if you'd like to see more like it, or if you'd prefer we focus on producing a smaller number of in-depth articles. Please click on the title of the article above and then leave your thoughts in the comments.