How COVID-19 broke my favorite labor economics chart

A longstanding connection between wage growth and employment levels has broken down.

There’s something strange about the American labor market right now. Almost every business seems to have a help-wanted sign outside. Employers are being forced to raise wages rapidly to attract workers.

Normally, this kind of tight labor market is a sign that the economy is firing on all cylinders—that strong demand is already putting every worker to work.

But we aren’t putting every worker to work. In fact, the percentage of workers in the workforce is well below levels reached in previous booms—including 1999, 2007, and 2019.

The result is a confusing and difficult situation for the Biden Administration. President Biden has staked his presidency on the idea that rapidly achieving full employment would produce economic benefits for the country and political benefits for the Democrats. In March, Democrats borrowed and spent $1.9 trillion to speed the economic recovery and achieve full employment.

But the complications of COVID-19 have produced a weird sort of quasi-full employment—one that’s not that great for the average worker or the average consumer. Wages are rising, but those gains are illusory because they aren’t outpacing inflation. And jobs are more arduous because of the pandemic.

This quasi-full employment, which remains short about seven million workers despite high demand and fast-rising wages, is a threat to Biden’s plans, which were built around the abundance of a true full-employment economy.

The relationship between employment and wages broke down

Before the pandemic, labor economists had a good theory about how wage growth and employment levels were related. It worked for decades prior to the pandemic. But it fell apart in the initial COVID-19 wave. Labor economists are scrambling to explain what seems to be unusually high worker bargaining power even in the face of low employment levels.

A graphical expression of this relationship was popularized by labor economists Adam Ozimek and Ernie Tedeschi. They tracked a measure called the Employment Cost Index (ECI) for wages and salaries. ECI is designed to measure increases in pay for the same job title, while ignoring shifts between occupations or industries. It is not adjusted for inflation. And they plotted ECI against the percentage of working-age adults who are employed.

The idea was simple: the more people are employed, the more bargaining power workers have to demand wage increases. This makes intuitive sense: if almost everyone already has a job, then an employer has to outbid other employers to get workers. And it held true throughout the pre-pandemic era, marked by the blue dots. Just prior to the pandemic, we were towards the upper right end of this curve. Employment levels were relatively high—about 80 percent of working-age people had jobs—and wage growth was high too—about 3.1 percent.

However, the post-pandemic relationship, denoted in orange, is a mess. And as of the most recent data, we do not seem particularly close to a return to the old norms. In the second quarter of 2021, only about 77 percent of working-age adults were employed, and yet, they were able to bargain for a high wage increase of 3.2 percent: even higher than they got in early 2020.

Early data suggest that the third quarter was similar. About 78 percent of working-age adults were employed. While third quarter ECI figures have not yet been published, analysts expect the wage growth figure to be high. Skanda Amarnath, the Executive Director of a full-employment research and advocacy group called Employ America, expects ECI to grow at about a 3.75 percent annualized rate. That would keep us well above the pre-pandemic curve.

In other words, we don’t have full employment, and yet workers are bargaining as if we do—measurably on wages, but perhaps also on pandemic-era benefits like working from home or flexible hours.

The puzzle: why isn’t it returning to normal?

This presents a puzzle: why doesn’t the chart work anymore? One easy culprit was expanded unemployment insurance, which paid people not to work and raised the reservation wage. But the pandemic-era expansion of unemployment insurance has expired, and its effects seemed modest, if that.

Another hypothesis is that a particularly speedy return to work requires faster wage growth than a slower pace. “I think the wage pressure right now is a speed effect,” Amarnath tells me, “almost entirely.”

Another thesis gaining steam is that people have excess savings, and they are burning through some of those savings before returning to work. This idea has reportedly caught the attention of White House advisor Jared Bernstein, after data put forward by Moody’s Chief Economist Mark Zandi suggested middle class Americans have about two and a half months of excess savings they could exhaust before taking a job.

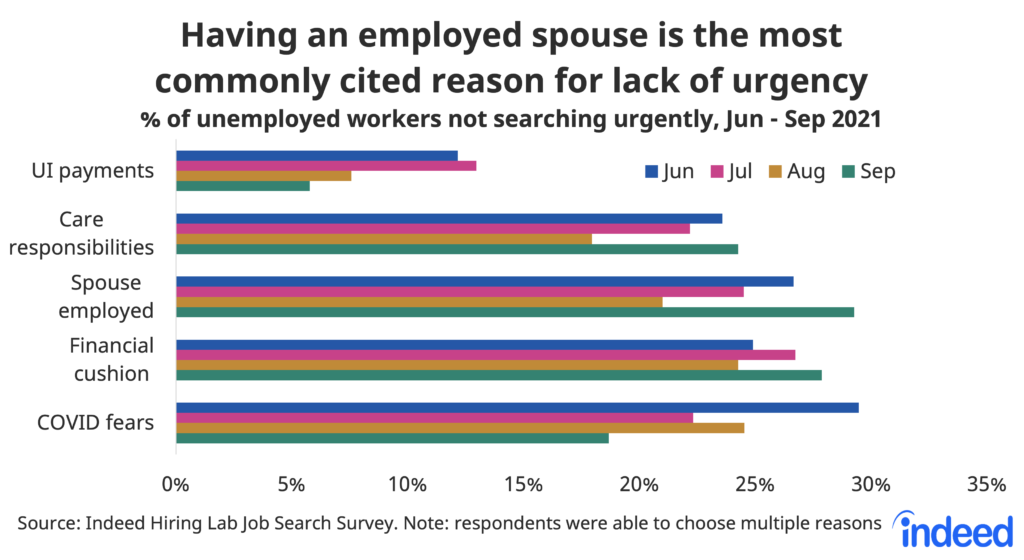

The job search company Indeed has been surveying unemployed workers on why they might not be searching urgently, and a variety of answers are cited. Notably, UI payments are substantially less significant than other reasons, and dropping as the expanded benefits expire.

There’s also evidence of the same kind of tight labor market elsewhere in the world: for example, the United Kingdom also reports record job vacancies even as fewer workers are employed than before. This suggests that no particular U.S. policy is primarily to blame.

There’s no question as to the ultimate cause: the culprit must be COVID-19 itself in some form, and the question is merely the mechanism by which it keeps people from working.

The simple reason: jobs are worse

The best explanation is that the job offers simply aren’t as good, from the worker’s perspective, as wage growth figures might suggest. Matt Darling, an Employment Policy Fellow at the Niskanen Center, outlined some of the reasons in a conversation with me. “Working conditions have gotten much worse for many jobs. Most obviously, people are going to be wary about in-person jobs that could lead to higher infection risks.”

In other words, while the pay per hour might be good, jobs are less pleasant than they used to be. Darling adds some more examples: “Workers are also being asked to do more; they may be asked to enforce mask mandates. The labor shortage can also be self-sustaining. People will not want to work at companies that are short-staffed, and might wait until they can expect a normal workload.”

At the same time, the pay isn’t as good as it looks. The high nominal wage increases have been swallowed by unusually high inflation; in fact, adjusted for the personal consumption expenditures (PCE) price index, which rose 4.3 percent over the last year, pay is in decline.

Furthermore, official inflation measures like PCE probably understate the degradation of quality in consumer experiences. Many customer amenities have been cut back and no activity is fully safe from COVID-19 transmission risk. So the real value of a worker’s wages—adjusted for declining quality—has fallen even more than the official 4.3 percent number suggests.

Jason Furman, a former economic advisor to President Barack Obama, noted in 2018 that the relationship between wage growth and employment levels had only held tightly since the start of the so-called Great Moderation, a long period where inflation was contained below two percent. In the past, like the 1970s, inflation was higher, and workers demanded larger raises. This may be happening again. The relationship plotted in our chart above may not return until the pandemic and inflation are both once again under control.

People ultimately go to work in order to earn money to spend, often outside the home; COVID-19 has attacked the value proposition of work from two different angles: work is more difficult, and its rewards are not as valuable.

By contrast, work inside the home—such as care responsibilities—can be just as productive and rewarding as before. If you’ve cut back your spending, and you have a working spouse and children, why not help out around the house and with childcare, saving on childcare expenses? These activities are relatively unharmed by the pandemic, and have become better by comparison. The responses from the Indeed survey are illustrative.

Remember: it’s not that everyone is out of a job, it’s just that 78 percent of working-age people are employed rather than a pre-pandemic 81 percent. Is it so hard to imagine that an additional 3 percent of people decided they have better things to do at home than don a mask and risk COVID exposure at work?

It may be hard for employers to hear this: as they see it, they are making a good-faith effort to raise wages and attract workers. But difficulty from the employer’s end does not imply happiness from the worker’s end. Good-faith efforts might not be enough. Market activity—activity outside one’s own household—has suffered an economic shock, and domestic activity within one’s household has become relatively more attractive.

This is not a happy story

It is easy to cheer on the higher wages, but this is ultimately not a happy story. One important way to increase real growth is to create jobs, and move rightward on the chart above. But we aren’t doing that fast enough: we’re doing less work than we did before, and as a result a lot of cash is chasing a limited amount of production, creating inflation.

So the raise you get from your own short-staffed firm to retain you might be a good thing for you. But at the same time, short staffing in shipping or in food service is a problem for you when your household goods get more expensive and your favorite restaurant isn’t well-staffed.

Simply put, “worker power” with fewer jobs than before is not as good as it looks. Even if the American Rescue Plan and other recent fiscal packages were the right call for creating a recovery, we should have hoped that the additional spending would put more people back to work and bring more goods and services into production, rather than raising prices.

Given the salience of the inflation issue, and given the Biden administration’s commitment to bringing people back into the labor force through demand-side expansionary policy, an inability to get millions of workers to return is an existential threat. In a sense, we ultimately “pay for” agendas like Build Back Better with labor, and the less labor we have, the more stretched our budget is.

There is no way to force workers to come back to unattractive jobs; many cite an employed spouse or a financial cushion or both. We instead have to make jobs more attractive, and that ultimately means getting COVID-19 under control.